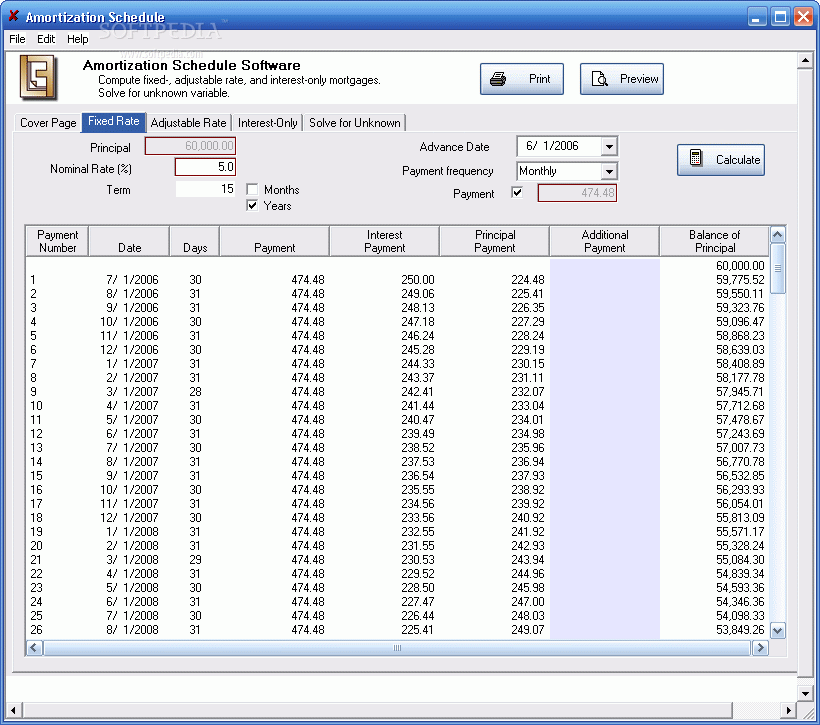

amitorization schedules::Unlike some other amortization calculators, this one takes rounding into account, and still makes the end balance zero.

amitorization schedules::Unlike some other amortization calculators, this one takes rounding into account, and still makes the end balance zero.You just enter the loan amount , the interest rate , the term of the loan, date of first payment , and the payment frequency.

Investigate how making extra payments or balloon payments will affect the total interest paid and determine how soon you can pay off the loan.

Apply to consumer loans , car loans , and home mortgages.

For more information about amortization schedules and the calculations used to create them, see the help content below, as well as the references.

Interest rate, compound period, and payment period usually, the interest rate that you enter into an amortization calculator is the nominal annual rate.

However, when creating an amortization schedule, it is the interest rate per period that you use in the calculations, labeled rate per period in the above spreadsheet.

Basic amortization calculators usually assume that the payment frequency matches the compounding period.

In that case, the rate per period is simply the nominal annual interest rate divided by the number of periods per year.

The interest portion of the payment is recalculated only at the start of each year.

The way to simulate this using our amortization schedule is by setting both the compound period and the payment frequency to annual.

A loan payment schedule usually shows all payments and interest rounded to the nearest cent.

That is because the schedule is meant to show you the actual payments.

Many loan and amortization calculators, especially those used for academic or illustrative purposes, do not do any rounding.

When an amortization schedule includes rounding, the last payment usually has to be changed to make up the difference and bring the balance to zero.

This might be done by changing the payment amount or by changing the interest amount.

Changing the payment amount makes more sense to me, and is the approach i use in my spreadsheets.

So, depending on how your lender decides to handle the rounding, you may see slight differences between this spreadsheet, your specific payment schedule, or an online.

You simply add the extra payment to the amount of principal that is paid that period.

For fixedrate loans, this reduces the balance and the overall interest , and can help you pay off your loan early.

This spreadsheet assumes that the extra payment goes into effect on the payment due date.

There is no guarantee that this is how your lender handles the extra payment!

However, this approach makes the calculations simpler than prorating the interest.

One of the challenges of creating a schedule that accounts for rounding and extra payments is adjusting the final payment to bring the balance to zero.

In this spreadsheet, the formula in the payment due column checks the last balance to see if a payment adjustment is needed.

Normally, payments are made at the end of the period.

You may need to change this option if you are trying to match the spreadsheet up with a schedule that you received from your lender.

One way to account for extra payments is to record the additional payment.

No comments:

Post a Comment